Optimal market making

Swaap v2 models aim to optimize the risk adjusted returns of Liquidity Providers against a “buy & hold” strategy (HODL). Such models have been built by addressing the limitations of traditional AMMs.

Challenges with Traditional AMMs

As previously explained, although AMMs have solved issues like openness and custody risks, they have been found to provide poor performance, on average negative returns with high risk. Such performances can be explained by mainly two elements:

- Lack of integration of external data sources: AMMs rely exclusively on their own information. This results in losses for Liquidity Providers who face toxic trading flow (arbitrage)

- Simplified algorithms: AMMs generally rely on the constant product formula, which is not optimized for profitable market making. Decades of research in Traditional Finance have shown that other approaches, such as stochastic models tend to provide better risk adjusted returns.

The approach with Swaap v2

Swaap v2 addresses the limitations of traditional AMMs.

Integration of Low Latency External Data Sources: Swaap v2 incorporates external price feeds (e.g., prices of assets on Centralized Exchanges) into its quotation module. This strongly reduces the toxic flow that other AMMs undergo. By having the quotation module offchain, Swaap v2 is able to have access to this information with very short latency, further optimizing the efficiency of the models.

Fundamental Mathematical Approach: Swaap v2 leverages the most advanced research in market making in Traditional Finance and adapted said models to the infrastructural specificities of Decentralized Finance. Models used have been detailed in the following research paper. Detailed in a research paper, these models are not only theoretical but are also practically tested and refined using Pyth Network's historical market data. This robust data infrastructure supports backtesting and ongoing research, enabling Swaap to analyze market trends and asset performance over time. By continuously refining its strategies through this data, Swaap ensures its offerings are well-suited to meet the evolving needs of its Liquidity Providers (LPs).

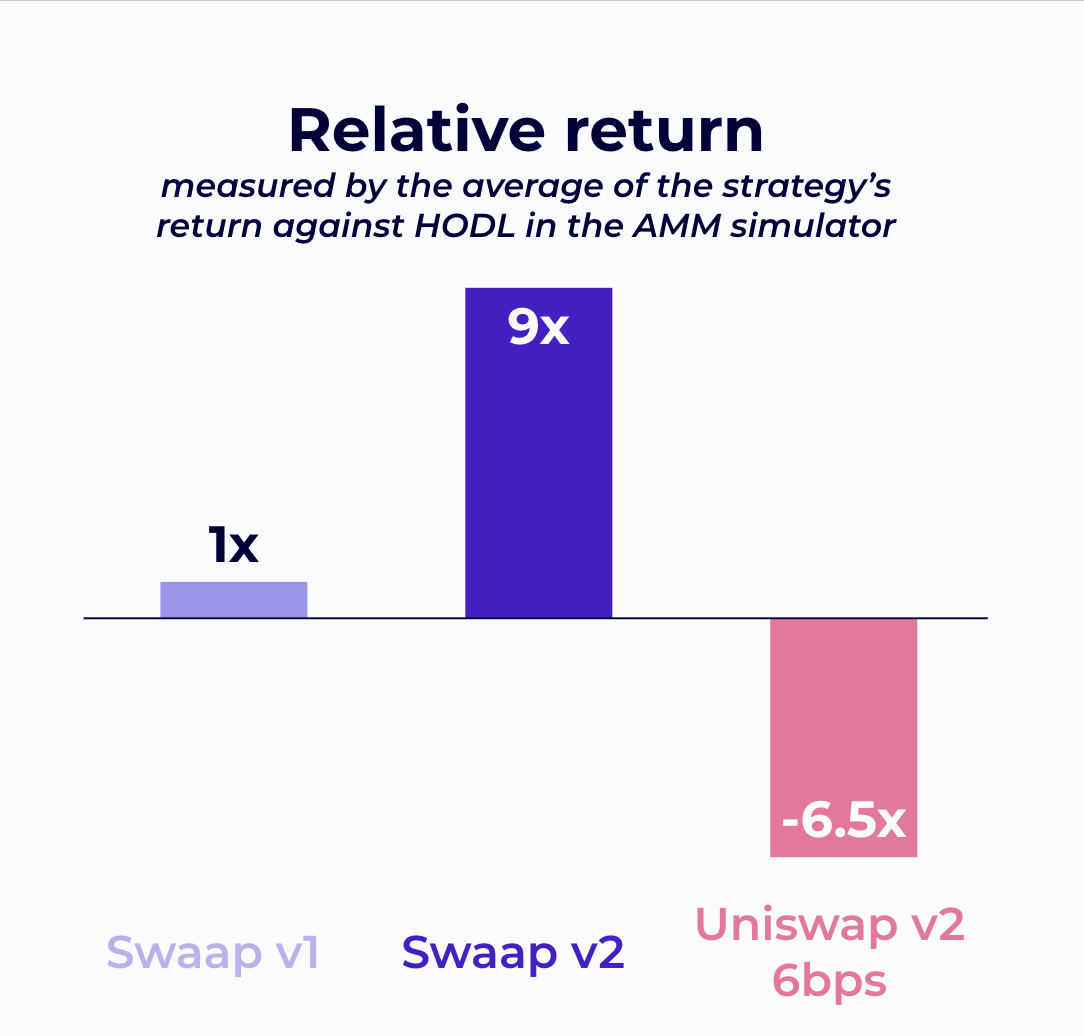

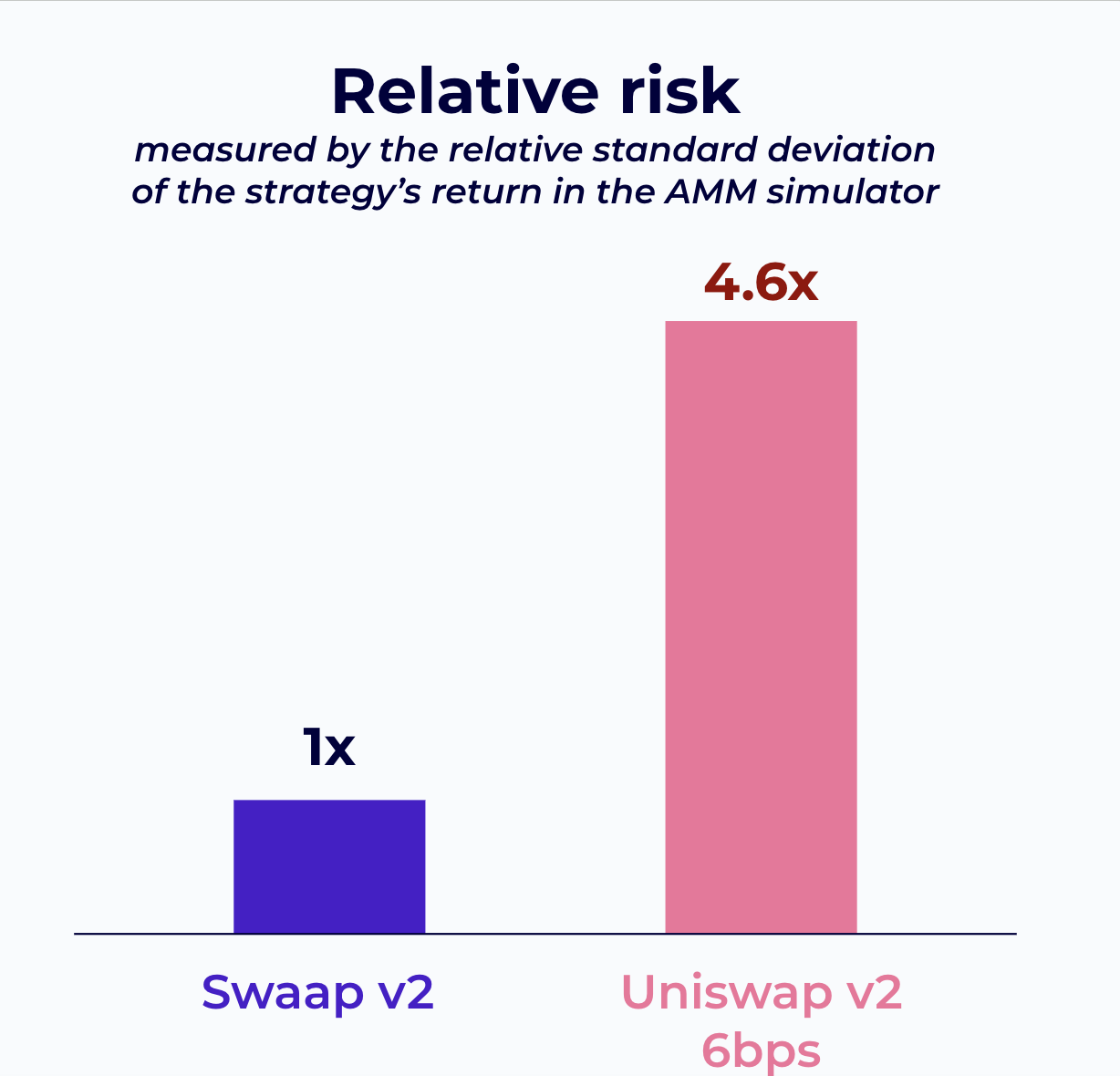

Simulated results

Based on simulations conducted using the AMM simulator, a tool developed in the context of the publication of the following research paper, you can find below a performance comparison of a specific implementation of Swaap v2 compared to Uniswap v2.